Making a budget is for nerds, right? Wrong. Budgets are for anyone who wants to get to their financial goal more quickly.

A financial goal can be anything that matters to you, such as:

- to not worry that your card will get declined at the grocery store

- being able to take a year off to travel the world

- to have saved up enough for the down payment on a house

- to have enough money left at the end of the year to buy Christmas presents for your family and friends.

Your financial goal may be different to everyone else’s but you will get there more quickly with a budget!

- What is a budget and why is it important?

- How do you make a budget?

- Common questions about budgeting…

This post may contain affiliate links. That means if you click and buy, I may receive a small commission (at zero cost to you). As an Amazon Associate I earn from qualifying purchases. Please see my full disclosure policy for details.

What is a budget and why is it important?

A budget is an estimate of your income and expenses over a set period of time. A budget is important because it shows you if you will have enough income to cover your planned expenses. It also lets you plan ahead, so you will know how much money you have to spend or save over a set period of time.

In a study recently released by the Federal Reserve, based on a survey they did in 2019 (before the recent financial crisis set in), 16% of adults couldn’t pay all of their current month’s bills in full. Another 12% said they would not be able to pay their current month’s bills in full if they had an unexpected $400 expense. And 25% of adults had skipped medical care because they couldn’t cover the cost.

Following a personal budget can help to keep you out of debt, because if you follow your budget plan then you are ready for the unexpected expenses, can plan for medical costs, and you won’t spend more than you earn. A budget can also help you to pay off debt more quickly because you can plan to put more of your income towards debt repayment.

We will start by showing you the steps you need to follow to make a budget. Read all the way to the bottom to see what an ideal budget might look like, and what to do if your expenses are more than your income.

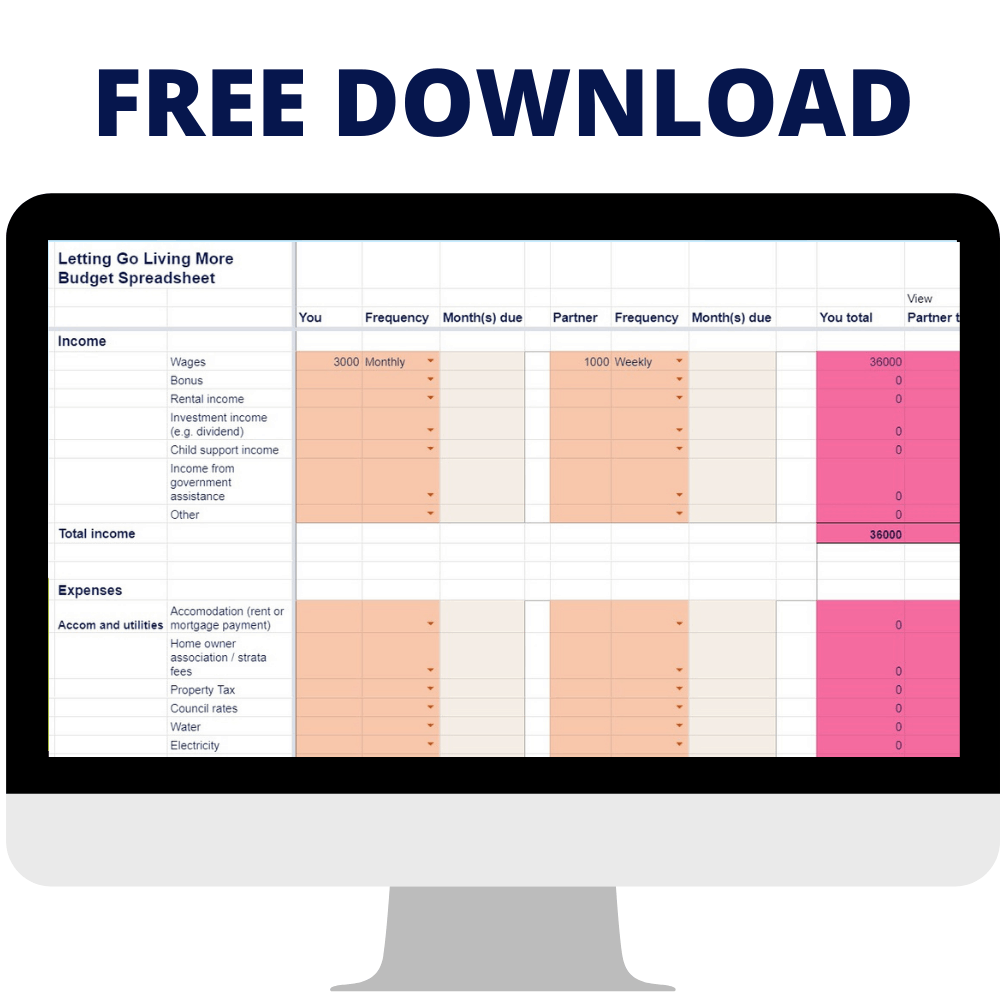

You may already have an idea of how you want to write out your budget, but I have made a household budget spreadsheet for you which will make getting through the steps much easier. Download it below to get started. Otherwise scroll down to read the next steps.

How do you make a budget?

Step 1: Start with your money goals

Do you want to pay off debt? Are you saving for the down payment on a house? Are you planning a big holiday? Do you want $5000 in savings by the end of the year?

Try to think about both short term goals (like a holiday this year) and long term goals (like saving for your college for your children, or saving for your retirement). WRITE DOWN YOUR GOALS. This will help you to focus as you work through the other steps.

Step 2: Get all of your income and expenses in one place.

Do this at least for the last three months but ideally for the last year. Download your transactions from your online banking, or get all of your paper bank and credit card statements together.

Step 3: Work out your income and write it down

I find it easiest to budget using a full year of income. If you are including your before tax (or pre-tax) income, then make sure that you include your tax amount as an expense. If you are including your post tax income (the amount of money you receive after tax) then you do not need to include the tax as an expense in your budget.

What if my income isn’t the same each week or month?

If you want to budget on the safe side, only include income that is guaranteed (for example, do not include bonuses unless you always get them).

If you do not have the same income each month (e.g. if you are self employed) then decide how you want to budget. You can use the last 12 months’ income as the guide for your budget income.

If you want to budget more conservatively, you can take the lowest month of income you had in the last 12 months and multiply it by 12. This means that even if you only make the minimum each month for the full 12 months, you will have planned your expenses to get through it.

Step 4: Write down all of your expenses.

Remember some expenses only come up once a year, so make sure you include these (things like car servicing and vehicle tax). If an expense comes in every month for the same amount, you need to multiply it by 12 to get the annual amount. Don’t get caught out by items that are weekly (multiply by 52 to get the full year amount), fortnightly (multiply by 26 to get the full year amount) or quarterly (multiply by 4 to get the full year amount).

Some people get stuck at this point as they are not sure how many categories to include in the budget. If you prefer to track with just a few categories (e.g. rent, utility bills, groceries, entertainment, insurance, medical) then that is fine – just make sure you do not miss any expenses. It can take a bit longer, but including more categories can make it easier to track your expenses, and quickly spot where you are overspending.

Want to make this step easier? Grab my free budgeting spreadsheet below. It includes lots of expense categories that people often forget when making a budget. It also let you select for each income and expense item whether it occurs weekly, fortnightly, monthly, quarterly or annually, and then automatically calculates the full year amount for you (or another timeframe if you prefer to budget that way).

Step 5: Work out your net income

Your net income is your income minus your expenses. If your income is more than your expenses, your net income will be positive. If your expenses are more than your income, your net income will be negative. This is when you are likely to be getting into debt, because you are spending more than you are earning.

Step 6: Look at ways to save. Be realistic.

Look back to step 1, and why you are making a budget. Now look at your net income. Is your net income enough to help you to reach your goal? If not, it is time to start reducing your expenses. If you are spending more than you are earning, it is definitely time to start reducing your expenses!

Now that you have all of your expenses listed out, look at ways you can save.

Are there any expenses where you are spending more than you expected (e.g. eating at restaurants, or trips to the movies). Are there any expenses you had forgotten you were paying (e.g. monthly subscription for a newsletter that you no longer read) that you can cut out?

Make any changes that you can to your budget to reduce your expenses. Be realistic here. If you currently spend $1000 a month on groceries, it is unlikely you can immediately reduce this to $200. If you’re not sure how much you should be spending on groceries, then take a look at my guide on how much to budget for food.

It is better to start with smaller changes and build up, than to try to make huge changes and then be discouraged when you can’t make it work.

Make sure you have a plan for the money that is left over once your expenses are paid. Use the money to pay off existing debt or put it aside in a savings account. This will stop you from spending it on other things.

Step 7: Track it!

Now that you have made your budget, you need to track your actual income and spending against your plan. It is best to do this weekly or monthly, so that you can quickly see areas you are overspending and adjust other expenses to make up the difference.

If you have a week or a month when you go way over, do not give up! Look for any savings you can make elsewhere in your budget, and then just get yourself back into trying to keep to your plan. Change is hard, so if you are trying to reduce spending for the first time, you might not get it all right the first time. Keep at it, and you will get there.

Common questions about budgeting…

What does an ideal budget look like?

Once you have put together your budget, you have a pretty good idea of where your expenses are going. There are lots of ‘rules’ about the best way to allocate your expenses.

The 50 30 20 rule says that you should allocate:

- 50% of your post-tax income to your needs (e.g necessary costs to live, like rent, bills and food)

- 30% of your post-tax income to your wants (e.g. holidays, entertainment, eating out)

- 20% of your post-tax income to financial goals (e.g. retirement savings, paying off debt)

The 70 20 10 rule says you should allocate:

- 70% of your post-tax income to expenses (that’s all of your spending)

- 20% of your post-tax income to savings (unless you have pressing debt like a credit card or personal loan)

- 10% of your post-tax income to debt payment (such as your mortgage)

You don’t have to follow either of the rules above, they are just guides. But you should look at your goals, and make rules that help you to meet your goals.

If you want to retire at 50, then you are going to need a good chunk of your income going into retirement savings.

If you want to pay off debt, you need to reduce your other spending as much as possible so you can put all of the extra money towards debt payments.

What is a zero sum budget?

A zero sum budget is a way of budgeting to allocate every dollar every month. It means you don’t have anything “left over” at the end of each month. That does not mean you spend everything you make! It means that you give every dollar a job.

For example, if in your normal budget you have $200 left at the end of the month, in a zero sum budget you could choose to allocate that money to savings. It stops you from thinking that you have $200 as extra spending money, and instead makes you think about how to put every dollar to work in your budget. This is a great mindset for budgeting, and should reduce spending on things that are not planned.

What if my expenses are more than my income, even after I tried to reduce them?

Firstly, make sure you really are reducing your expenses.

If you are spending more than you earn, you should be cutting down on things like eating out and entertainment (even if you REALLY love going out for dinner).

If you have cut out all of the extra expenses that you can, and you still don’t have enough income to cover your expenses, then you have an income problem. That means you are not earning enough money.

Take a look at these ways that you can earn more income.

Should I use a budgeting app?

Everyone is different. The best thing to track your budget is the thing you will use!

I use pen and paper as I find that a planner works best for me (and it helps with all of my home organisation, not just my budget).

Lots of people are moving to apps because they can usually integrate with your online banking which means you can track your budget in real time without having to remember to write down each expense.

This all feels a bit overwhelming, do I really need a budget?

Go back to the first action in this article, which was to work out your money goals. If you want to finally get out of debt, or save your first $5000, or go on that amazing holiday, then a budget will get you there more quickly.

Imagine how you will feel six months from now to be on your way to your goal.

Now stop imagining, and start doing!!

Sharing is caring!

15 thoughts on “How to make a budget and stick to it!”

Great advice. This pandemic taught us so many things starting with we was not prepared. Thanks for the post!

No problem Katrina, putting together a budget is definitely a great start to prepare for the unexpected financial bumps.

Thank you for this! I need to get my budget under control before Christmas!

No problem Jennifer. Look out for my article coming soon about how to budget for Christmas!

I had never heard of a zero sum budget before, but it makes so much sense! I really need to get back to budgeting so that I know I’m saving as much as I really should be. Thanks for the insight!

I agree the zero sum budget is a game changer. When you start budgeting all of your money and savings rather than seeing anything extra as spending money, it’s amazing how much money you can save!

What I always forget about budgeting is that it’s a living thing. Several years ago, I created a budget for my family. I stick to it (mostly) but it’s not really accurate anymore. I know I need to redo it, that I should probably be revisiting at least once a year. But it’s just so easy to say this one’s already done, what do I need to do it again. Sigh.

I know it seems like such a big task. If you haven’t already, I recommend getting the budget spreadsheet above. It’s got inbuilt formulae so even when your income is monthly, but bills are weekly or quarterly, it will calculate everything for you based on the timeframe you select. I think alot of the overwhelm for people is working out how to make all of the numbers work on a weekly or monthly basis, so have tried to make sure that step is done for you!

I like that 50-30-20 rule! Now off to check my budget to see how close we are to that! 🙂

It’s a great rule to use as general guidance for your budget. Be sure to tweak it as you need to make sure it fits with your financial goals 🙂

Great post. Your information is so detailed and usable! Thank you for sharing!

Thanks for sharing this post! It’s good to have a refresher on this topic (doing most of them on a regular basis)😊

Glad you enjoyed it, and amazing work on already doing most of them!

Great article! I have a budget but I am not doing the 50-30-20 so when I travel it screws everything up. I am going to look at my budget and work towards having 50-30-20 as my goal. Thank you!

The 50 30 20 rule is a great one to just keep everything in check. Depending on how often you travel, perhaps allocate a little money each week towards the travel budget fund, so by the time the trip comes around you have money set aside for it and can just enjoy the trip.